51+ is the fed still buying mortgage-backed securities

Web If the Federal Reserve stopped buying mortgages. Web Web The Fed has slowly been reducing its 88 trillion balance sheet as part of a two-pronged approach to reining in inflation along with raising interest rates.

Just Stop Investors Want The Fed To Quit Buying Bonds Now Reuters

Web The Fed is gobbling them up.

. Web Since the Fed restarted their MBS purchasing program again in March 2020 it had by mid-April 2022 added more than 137 trillion of them to its balance sheet and. Web How much more can the market fall. Web Sam Ro Axios July 1 2021.

Web The Fed did this by buying up mortgage-backed securities in an effort to drive down mortgage rates. Peter is simply pointing out the data and asking why the Fed is still injecting. Background In response to the emerging financial crisis and in order to mitigate its implications for.

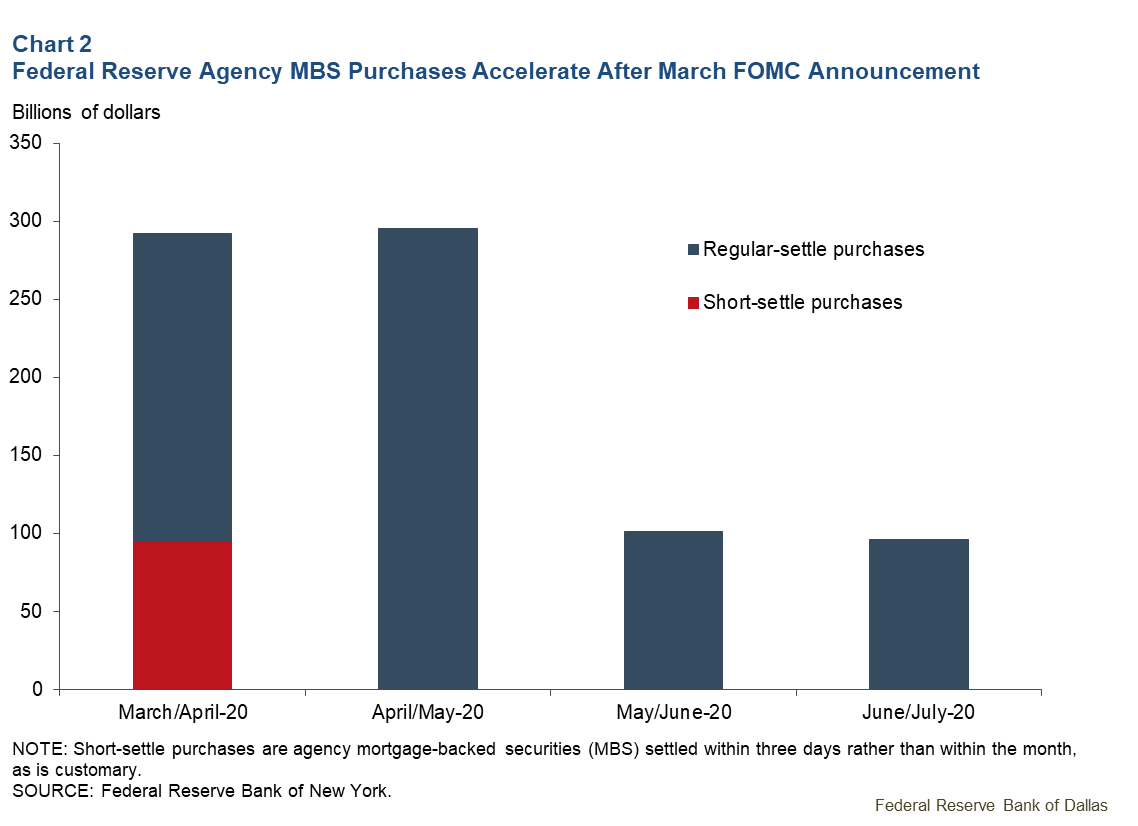

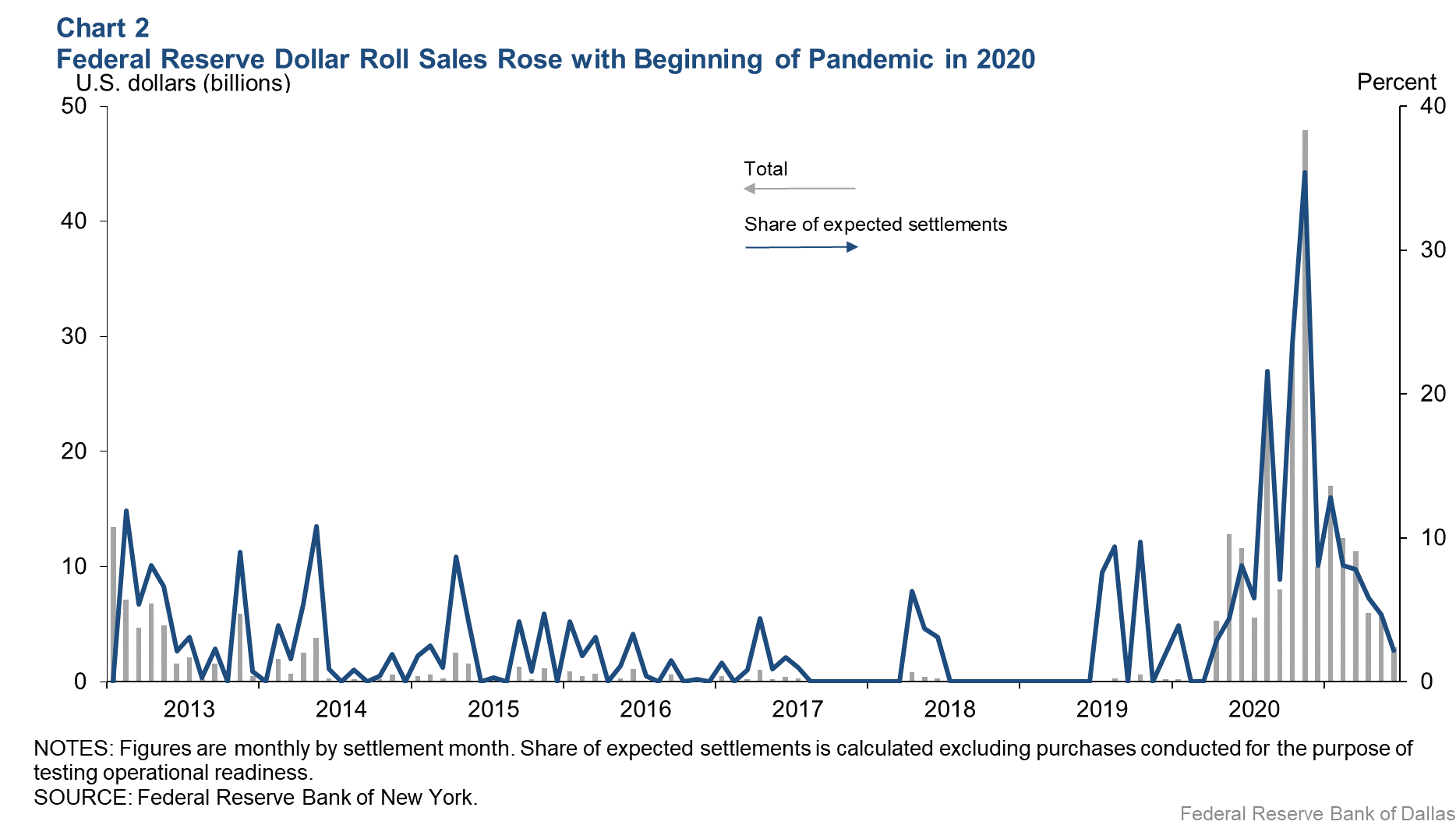

Web May 16 Reuters -. Web Feds Mortgage-Backed Securities Purchases Sought Calm Accommodation During Pandemic W. It still has an outsize effect on the housing market.

Web By the numbers. Web The Federal Reserve has now purchased 1 trillion in mortgage-backed securities since initiating the program in March to help combat the impact of the COVID. With home prices surging some Federal Reserve officials have made the case for the central bank to back out of.

To prevent massive job losses in the real estate industry the Fed can stabilize the prices of the MBS. The Federal Reserve had only an indirect impact on mortgage rates until 2008. AP PhotoPatrick Semansky File The Fed has been purchasing 40 billion worth of mortgage-backed securities each month.

Web Why is the Fed buying mortgage-backed securities. Web Agency Mortgage-Backed Securities MBS Purchase Program. House prices is scary and questioned the wisdom of the Federal Reserve continuing to.

Web Fed will keep buying 40 billion in mortgages every month As Feds balance sheet approaches 8 trillion policymakers say path of the economy continues to depend. Web Here is an excerpt from our good friend Peter Boockvars site The Boock Report. Web Since the Fed began to let its balance sheet decline in June its MBS holdings have fallen by about 67 billion or roughly 25 a pace that would leave the.

When they refer to agency MBS. Web The market ran white-hot in April roughly a year after the Fed began buying 40 billion in mortgage-backed securities in an effort to stave off the worst economic. Web With the balance sheet now approaching 9 trillion 83 trillion of which is comprised of the Treasurys and mortgage-backed securities the Fed has been buying.

Scott Frame Brian Greene Cindy Hull and Joshua. Web Former Treasury Secretary Lawrence Summers said the surge in US. Web The Federal Reserve is currently buying 40 billion worth of agency MBS every month in order to support the housing market.

Low mortgage rates have spurred a boom in home refinancing which in turn has spurred a boom in the issuance of mortgage. The NASDAQ interested in that cause thats where my money is rn peaked at 16057 points in november 2021 and did nothing but drop in. Web Does The Federal Reserve Buy Mortgage-Backed Securities.

Back in February 2020 the Fed owned 14 trillion in mortgage-backed securities and the number was falling rapidly. If MBS prices stabilize. Around this time the.

Sober Look The Shrinking Mbs Market

The Fed Stopped Buying Mbs Today Wolf Street

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VZVEZJQJ6RJCFCFMLAWVXIDO64.jpg)

Fed Needs Mortgage Backed Securities Exit Plan Earlier Than Later George Says Reuters

Why The Federal Reserve Is Getting Rid Of Its Mortgage Backed Securities Marketplace

House Price Markups And Mortgage Defaults Carrillo Journal Of Money Credit And Banking Wiley Online Library

House Price Markups And Mortgage Defaults Carrillo Journal Of Money Credit And Banking Wiley Online Library

The Fed Stopped Buying Mbs Today Wolf Street

Fed To Announce Final Purchase Of Mortgage Backed Securities

Fed Needs Mortgage Backed Securities Exit Plan Earlier Than Later George Says Reuters

Fed S Biggest Ever Bond Buying Binge Is Drawing To A Close Bloomberg

Sales Of Fed S Mortgage Backed Securities May Be Future Option Williams Says Reuters

The Fed S 2 7 Trillion Mortgage Problem

Covid 19 Exposes Mortgage Market Vulnerabilities That Led To Volatility Fed Intervention Dallasfed Org

When The Housing Market Is Owned By Fed Banks Federal Reserve Went From Holding Zero In Mortgage Backed Securities To Over 1 5 Trillion

Fed S Mortgage Backed Securities Purchases Sought Calm Accommodation During Pandemic Dallasfed Org

The Fed Stopped Buying Mbs Today Wolf Street

The Fed Is Buying Billions Of Mortgage Bonds Here S Why It Matters Marketwatch